Become a responsible financial planner who can positively impact the future means of your clients

Consumers and clients are increasingly insisting on high-quality financial advice from advisors with the required qualifications, professional status and membership of a professional body. Stellenbosch Business School’s Postgraduate Diploma Financial Planning (PGDip FinPlan) can provide you with the ideal starting point.

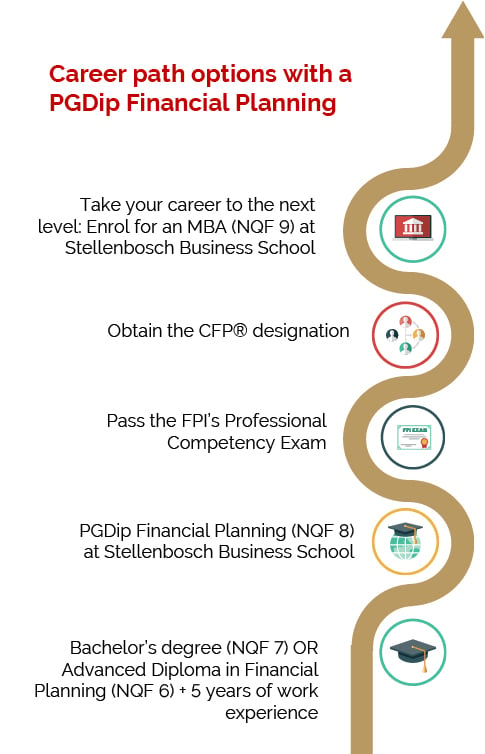

- Start your journey to become a CERTIFIED FINANCIAL PLANNER®: This PGDip FinPlan is a sought-after qualification that culminates in the internationally recognised CERTIFIED FINANCIAL PLANNER® (CFP®) designation – the global benchmark for professional financial advice. With this PGDip behind your name, you become eligible to apply for the FPI’s Capstone Course and financial plan assessment (pathway to become a CFP®).

- Study at an FPI-recognised education provider: Doing this PGDip at the Business School – an FPI-recognised education provider – comes with advantages like high-level engagement with students and excellent online resources.

- Gain access to an MBA: The PGDip is presented at NQF Level 8, the same level as an Honours degree. This means it can give you access to Stellenbosch Business School’s MBA.

- Study while you work: This one-year programme is offered in the convenient blended learning format, allowing you to study while you work. You can choose between on-campus sessions (with in-class experience) or blended learning (using an internet-linked laptop from anywhere in the world).

Postgraduate Diploma

Postgraduate Diploma Financial Planning

Blended

Dates for 2025*

- Orientation (remote): 27 January

- Classes from 28 January – 27 November

Fees: R65 668.00 (2024)

Duration: 1 year

*The Business School reserves the right to change programme dates and fees.

Blended learning format for 2025

- Orientation: 1 day – remote

- Classes: Weekly sessions presented on Tuesday and Thursday evenings, from 18:15 to 20:15. The blended learning format allows you to join the class on campus or via an internet-linked laptop (hyflex). This means you can study while you work.

Why enrol for this programme?

- Use this PGDip as starting point to obtain CFP® professional accreditation

- Invest in your career by establishing yourself as an expert

- Earn the trust of your clients

- Study at an FPI-recognised education provider

Course Structure and Content

It’s an investment in your future

Our PGDip Financial Planning is a sought-after qualification that culminates in the internationally recognised CERTIFIED FINANCIAL PLANNER® (CFP®) professional designation – the global benchmark for professional financial advice. Doing this PGDip at Stellenbosch Business School, which is an FPI-recognised education provider, comes with advantages like high-level engagement with students and excellent online resources. The PGDip is presented at NQF Level 8, the same level as an Honours degree. This means it can give you access to an MBA.

A transformative learning experience awaits you – particularly if you see your future self as a qualified and trusted financial expert.

Programme structure

This one-year programme consists of one orientation day (remote) followed by two online or on-campus sessions per week. The weekly sessions are presented on Tuesday and Thursday evenings, from 18:15 to 20:15. This is supported by additional pre-recorded content.

The blended learning format allows you to join the class in real time in one of two ways: via any internet-linked laptop, or on campus. The online classes are delivered synchronously with the on-campus classes. This means you can study while you work. It also means that you attend classes from anywhere in the world. Find more information about Blended Learning’s combination of technology with a strong human touch here.

The PGDip Financial Planning is a specialised programme aimed at helping you obtain CERTIFIED FINANCIAL PLANNER® (CFP®) professional accreditation. It is therefore aimed at professionals already employed in the financial services industry but who would like to further their career paths.

Do four compulsory modules

The one-year programme consists of four compulsory modules, each worth 30 credits. Modules 1 and 2 are presented during the first semester, and Modules 3 and 4 during the second semester.

Module 741: Financial Planning Environment

This module provides an overview of the field of financial planning. The principles and practices of financial planning and personal financial management are first addressed. This includes a review of the regulatory environment for financial planners. Students will also be familiarised with financial calculations and the concepts of the time value of money. The remainder of the module is devoted to tax planning and offers a detailed look at the Income Tax consequences for an individual.

Module 742: Corporate Financial Planning

This module focuses more on the corporate aspects of the employer-employee relationship. The first focus area is on business planning, which includes the taxation of different business entities. Next, the focus shifts to employee benefits and specifically retirement funds. Retirement planning, which includes the tax implications of retirement, death and divorce, is also covered in detail. The module concludes with an overview of medical schemes’ requirements and regulations, including developments that affect healthcare cover.

Module 743: Personal Financial Planning

This module equips students with the theoretical knowledge and practical skills to conduct a financial planning exercise for a client. The student will acquire in-depth knowledge of the structure, nature and tax of estate planning tools, including the law and taxation of trusts. Investment planning forms the backbone of this module, and students will gain valuable insights into how a client’s risk profile should be accounted for in order to address their needs. The module concludes by incorporating risk management, and differentiates between short-term and long-term insurance as part of the insurance planning exercise.

Module 744: Case Study

The programme culminates in a Case Study, where students are expected to integrate the knowledge acquired in the first three modules in order to prepare a comprehensive financial plan for a client. This module prepares students for the FPI’s Capstone Course and financial plan assessment (pathway to become a CFP®).

Stellenbosch Business School provides additional access to its programmes through its Recognition of Prior Learning (RPL) process, as recommended by the Council on Higher Education (CHE). The purpose of the Council on Higher Education’s policy on Recognition of Prior Learning is to develop and facilitate the implementation of RPL across the higher education sector and to base this on the principles of equity, access, inclusivity and redress of past unfair discrimination with regard to educational opportunities.

In line with the requirements of the Council on Higher Education, the Business School may admit up to 10% of its student body per programme under RPL.

Candidates who wish to be admitted under the RPL policy will firstly have to submit all the documentation as required for all prospective students. In addition, prospective students applying for this PGDip need to adhere to the following:

- Have at least an Advanced Certificate in Financial Planning at NQF level 6 from an FPI-recognised education provider

- Have at least 5 years of relevant work experience

- Submit a comprehensive CV, indicating detailed areas of responsibility as well as information of activities outside the work environment.

- Provide the Business School with the names and contact details of at least two persons who can testify about the candidate’s managerial or related professional abilities (typically current or former line heads). These persons will be required to give a detailed personal reference about the candidate on forms provided by Stellenbosch Business School.

The RPL selection process entails the following:

- The Business School’s Admissions Committee (programme head and another academic) will conduct an in-depth interview with the candidate and make a recommendation about admission.

- The Admissions Committee will consider the full application including the interview recommendation and the inputs received from the references for admission.

- A notice of admission is sent via the Business School’s Academic Planning Committee to the Board of the Faculty of Economic and Management Sciences at Stellenbosch University.

- RPL candidates need to apply by 31 October of each year to allow sufficient time for the assessment process.

Note that the learning acknowledged in terms of RPL cannot also be used to grant exemption of credits within the same programme.

This qualification will prepare you to ultimately become

a CERTIFIED FINANCIAL PLANNER® (CFP®) –

the global benchmark for professional financial advice.

Programme Fees

Application fee for 2024

Tuition fees for 2024

Important:

Important:

- Payment of full programme fees for South African students: Students can pay the full programme fees upon registration, or they can pay 80% of the annual fees by the end of May and the balance of 20% by the end of September.

Payment schedule (calculated on outstanding fee after deposit payment):

28 February - 31 May - 20% x 4 months (80%)

30 June - 20 September - 5% x 4 months (20%) - Payment of full programme fees for international students: International admitted students pay 50% of the annual fee as deposit. The remainder is due one month before commencement of the programme. The South African exchange rate favours international students.

- Deposit: All students pay a deposit on acceptance of admission. South African students must pay a set deposit on admittance. International admitted students pay 50% of the annual fee as deposit. The deposit payable is non-refundable and will be deducted from the total programme fees.

- Application fee: The application fee must accompany the application. The application fee is non-refundable.

- Study materials: Study fees include all study materials and access to a world-class e-book on investment planning.

- Travel and accommodation: Students are responsible for their own travel and accommodation arrangements and costs.

- Programme availability: The Business School reserves the right not to present a programme or programme stream if the enrolment numbers are not sufficient to make the programme sustainable.

- Fee changes: Stellenbosch Business School reserves the right to change the fees at any time.

Please use your Student Number as reference | Email proof of payment to [email protected] | Quote your student number in all correspondence.

Admission Requirements

Academic qualifications for regular applicants

A relevant Bachelor’s degree (e.g. BCom, LLB or BBusSc) at NQF level 6 (old) or 7 (new), or equivalent

What can this qualification do for you?

Once you have obtained the PGDip Financial Planning, you become eligible to apply for the FPI’s Capstone Course to obtain accreditation as a CERTIFIED FINANCIAL PLANNER® (CFP®). This designation will communicate your expertise and credibility locally and internationally.

What if you don’t have the academic qualifications to apply?

You can still apply if you have an Advanced Certificate in Financial Planning (NQF 6) from an FPI-recognised education provider, plus 5 years of relevant work experience. Submit all the documentation and assessments as required for all prospective students, plus additional requirements as explained under Recognition of Prior Learning elsewhere on this page.

- About the online application process: The online application form consists of various sections. To progress from the one section to the next, all the information in the current section must be completed and accepted by the information management system. You will be able to complete the form in steps without losing information (i.e. you do not have to complete the application form in one sitting). The application process is the same for South African and international students. It is best to use Google Chrome as web browser when completing your application.

- Determine the NQF levels of your previous qualifications: To find out whether you qualify for this programme, please check the NQF levels of your previous qualifications with the academic institution(s) where you have studied, or contact [email protected].

- About the online application process: The online application form consists of various sections. To progress from the one section to the next, all the information in the current section must be completed and accepted by the information management system. You will be able to complete the form in steps without losing information (i.e. you do not have to complete the application form in one sitting). The application process is the same for South African and international students. It is best to use Google Chrome as web browser when completing your application.

- Determine the NQF levels of your previous qualifications: To find out whether you qualify for this programme, please check the NQF levels of your previous qualifications with the academic institution(s) where you have studied, or contact [email protected].

- Assessment of international students’ applications: International students require a South African Qualifications Authority (SAQA) evaluation certificate to evaluate their degrees according to South African standards. The Business School’s International Affairs Office will first handle the credential evaluations of international students free of charge. For this to happen, you need to complete the online application, upload all certificates with your application, and pay your application fee. The International Affairs Office will then, as part of the application process, conduct an in-house credential evaluation after you have submitted your application. However, should the International Affairs Office be unsure about the status, recognition or accreditation of your qualification, we reserve the right to refer you to SAQA before we consider your application further.

- Checking the status of your application: You can go back to your application and check the status of your application.

- Vetting process: All degrees undergo a formal vetting process to eliminate fraudulent applications.

Click on the APPLY NOW button and complete the online application form by completing each of the required sections. You also need to upload the following supporting documentation:

- Completed and signed application form

- Certified copies of all academic records and degree/diploma certificates

- Detailed CV

- A copy of your ID (or passport for non-South African students)

- A marriage certificate (where the applicant’s new surname does not match that on the degree certificates)

- Consent form to verify your qualifications (please download, complete and upload the form in order for Managed Integrity Evaluation (Pty) Ltd to verify your qualification documents)

Payment of your application fee can be done online:

- Bank details: Bank: Standard Bank; Type of account: cheque account; Account name: US Business School; Account number: 073003069; Branch name: Stellenbosch; Branch code: 050610; Beneficiary name: Stellenbosch University; SWIFT code: SBZAZAJJ.

- Enquiries about payments: Please send an e-mail to [email protected].

What happens next?

Your application can only be assessed by the selection panel if it is accompanied by your completed online application form and all the supporting documents, and if you have paid the application fee. The outcome of the selection process will be made known within 30 days or as soon as possible thereafter. If you are uncertain whether your application is complete and is being processed, contact [email protected] for assistance.

Deadlines for PGDip Financial Planning applications:

- 30 November for applicants from South Africa

- 30 November for applicants from visa-exempt SADC countries, and the rest of the world

- 31 October for Recognition of Prior Learning applicants.

Also note the following:

- Deadline for RPL applicants: Note that application deadline for Recognition of Prior Learning (RPL) applicants are earlier than those for other students.

- Study permits for international students: Obtaining a study permit (study visa) from the South African authorities can take up to 12 weeks from the date of being offered a place on a programme at the Business School. An early start with the application process is therefore recommended.

- Multiple-entry visas: Students from non-SADC African countries and other countries with visa requirements who need to apply for study visas can obtain a letter from Stellenbosch Business School confirming the duration of registration at the Business School. This will help students to obtain multiple-entry study visas in case of modular studies.

Contact Us

Please contact us if you need more information on this programme or the application process:

Programme enquiries and support with the applications process

Henry Booysen

Telephone : +27 (0) 21 918 4243

Email: [email protected]

Admission and registration enquiries

Joanne Sleigh

Telephone: +27 (0) 21 918 4239

Email: [email protected]

Related Events

Stellenbosch Business School | Virtual Open Week 2023

Kampala, Uganda Information Session

Kigali, Rwanda Information Session

Frequently Asked Questions

Our student body comes from diverse backgrounds, both academically and professionally. Some have been in the financial services for many decades, others are fresh graduates. Although the majority of students have a BCom background, many are Law or BA graduates with the relevant work experience. Law students typically find the trust and estate planning sections easier (where court cases are discussed), but struggle with the investment planning section. We do provide a list of additional reading material, some of which are housed in the library on the campus. We also recommend students to do extra prep work. Ultimately, though, we have excellent internal pass rates, so our students adapt very well.

Essentially, you need a good support structure and the buy-in of your employer. We share the entire year’s lecturing schedule and assessment dates on Orientation Day (January each year), so you can negotiate study leave with your employer well in advance.

The lectures are recorded and uploaded to our online platform within a couple of days. This means students can catch up over the weekend. Also, the lecturing notes are uploaded at least a day prior to each lecture, so you can prepare in advance. We recommend that students form smaller study groups and help each other stay up to date. We also have two class representatives whom you can contact for additional help. In addition, we use various online resources and train you to optimally use fintech solutions.

Do not fall behind – we cover a large volume of work in a relatively short space of time. Use weekends to revise the previous week’s lectures. Work through all the tutorials and read the corresponding textbook chapter thoroughly. A selection of the previous year’s tests and exams are uploaded to our online platform. The lecturers conduct a special review session prior to the first test of each module. Thereafter, the suggested solutions to the past papers are also uploaded. Practise, practise, practise.

Stellenbosch Business School is an approved education provider of the FPI. Our graduates are therefore automatically eligible to write the FPI’s Capstone Course and financial plan assessment (pathway to become a CFP®). After the December graduation, you have to attend the FPI’s workshops to prepare for the FPI exam in February (or if you prefer, August). The Business School also offers an additional Saturday workshop exclusively for our own graduates at no extra charge. During the workshop, our lecturers will take you through a past case study exam of the FPI. Our PGDip Financial Planning also allows you to apply for our MBA.

Yes. Please look at the Recognition of Prior Learning (RPL) section elsewhere on this page. You must have an Advanced Certificate in Financial Planning (NQF6) and five years of relevant work experience to apply.

Yes, we offer this PGDip in blended learning format. This means you can do the programme from any internet-linked device. Each of the four modules has one examination. The examinations are done online in Excel. RPNow will be switched on for proctoring.

For RPL candidates: Yes. For other candidates, no. But we do find that those with some work experience in financial planning perform better.

Once you have registered as a student at Stellenbosch Business School, you automatically have access to our alumni and Career Leadership Office. Our graduates are also in high demand with leading financial services companies, who recruit from us. We regularly post job ads on our electronic platform.